For CFA candidates with one goal: Pass Level 1…FAST.

93 Secret Playbooks Top Scorers Use to Pass CFA Level I Without the 300+ Hour Grind

CFA Level 1 has 10 volumes, 93 modules, 3400+ pages of noise🤯. All to solve 180 questions.

Our CFA Exam experts stripped it down to the exact formulas, logic, and decisions you need to solve the 180 exam questions in 90 seconds flat.

DOWNLOAD ALL PLAYBOOKS FOR JUST $10 👇🏻

$10 USD = Rs.890

↓ Play To See What EACH Playbook Contains ↓

↓ Or Scroll Right To See What EACH Playbook Contains ↓

Here's What CFA Candidates Say:

These Playbooks will help you...

Save hundreds of hours of study time

Stop wasting time on low-yield material

Remember formulas & key terms under pressure

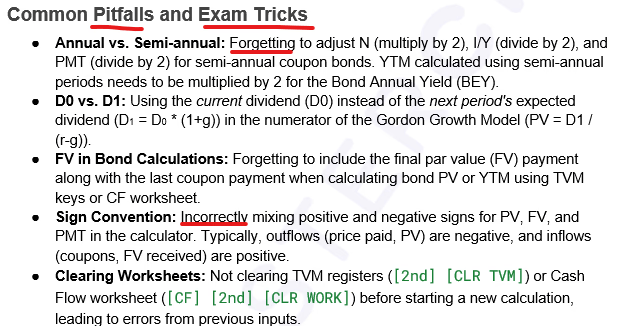

Avoid silly mistakes that kill your score

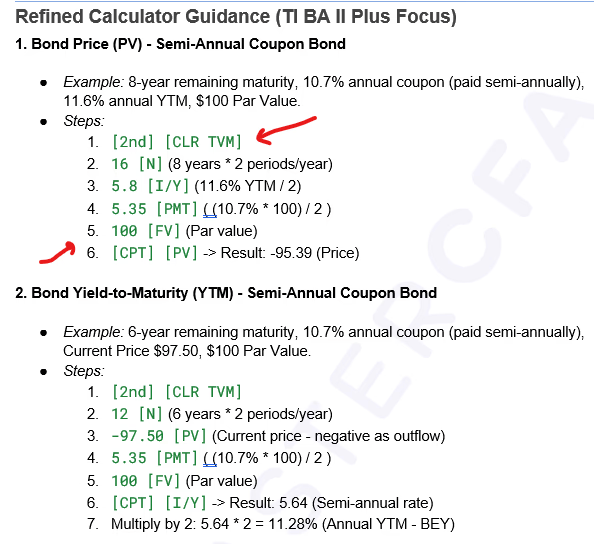

Execute calculator keystrokes flawlessly

Pass CFA Level 1 on your first attempt

Who Is This For?

These playbooks will help you in three main study situations. If you're in one of these situations, this will be a perfect fit!👇🏻

First-Time Candidates

Busy & Overwhelmed by curriculum

Working Professionals

Time constrained & Less than 5 months to prepare

Exam Retakers Who Need The Edge

Need to get over 70%+ to feel confident

👇🏻HOW THESE PLAYBOOKS WILL HELP YOU👇🏻

Confused About Where To Start?

Prioritized Study Order

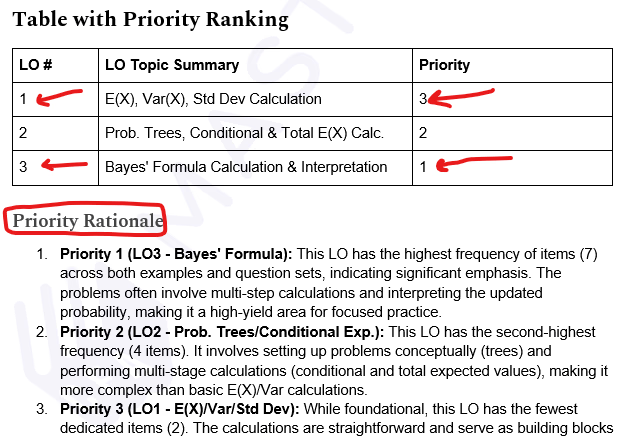

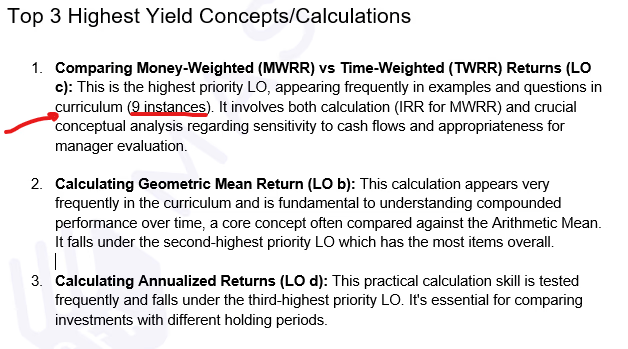

Not everything is EXAM important - our LOs priority shows you what you should focus to maximise your score.

Quick Review

Find out what you already know & what you don't know. Instead of sitting through hours of videos and pdfs get the big picture in 1 page.

$10 USD = Rs.890

👇🏻HOW THESE PLAYBOOKS HELP YOU👇🏻

Making Mistakes & Scoring Low?

Shortcut To High Score

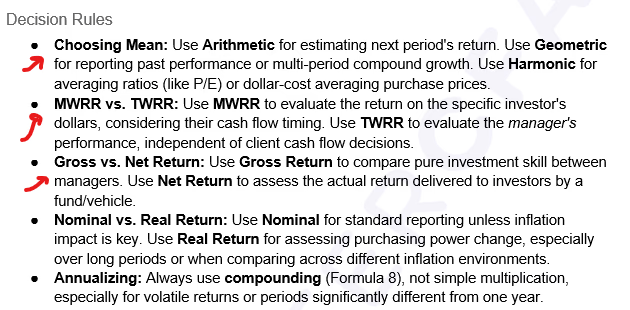

Simple IF-THEN decision rules for crushing the exam questions faster under pressure.

Silly Mistakes To Avoid

A list of all the silly mistakes and examiner tricks to score higher.

$10 USD = Rs.890

👇🏻HOW THESE PLAYBOOKS HELP YOU👇🏻

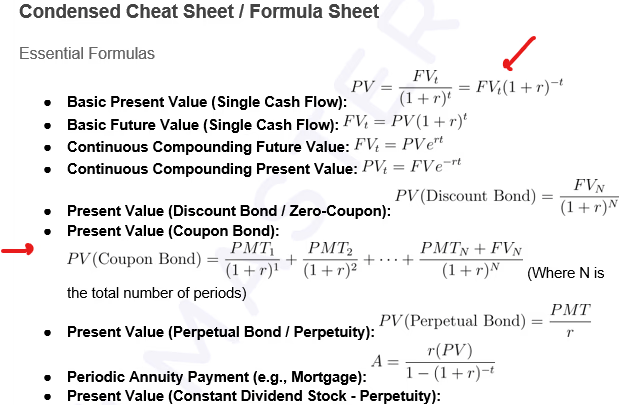

Forgetting Formulae & Application?

Calculator Mastery

Step-by-step keystrokes for high-probability question patterns. Stop fumbling, start executing.

Formula Application Drills

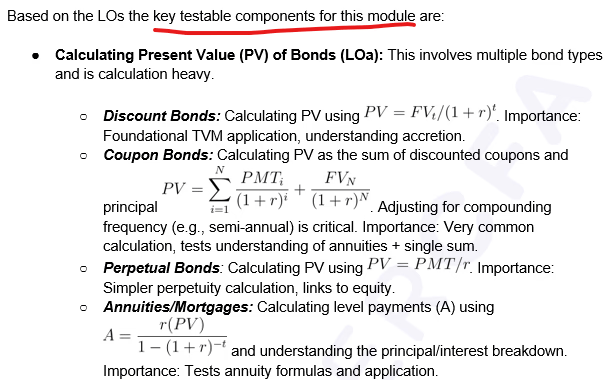

When and how to use each formula correctly under exam pressure.

$10 USD = Rs.890

👇🏻HOW THESE PLAYBOOKS HELP YOU👇🏻

Looking To Quickly Revise Daily?

High-Yield Question Patterns

No fluff. Guaranteed-to-be-tested question types per module. CFA Institute NEEDS to test these to test your knowledge.

Quick Exam Essential Concepts

List of all the testable concepts that you need to understand a questions and solve it confidently.

$10 USD = Rs.890

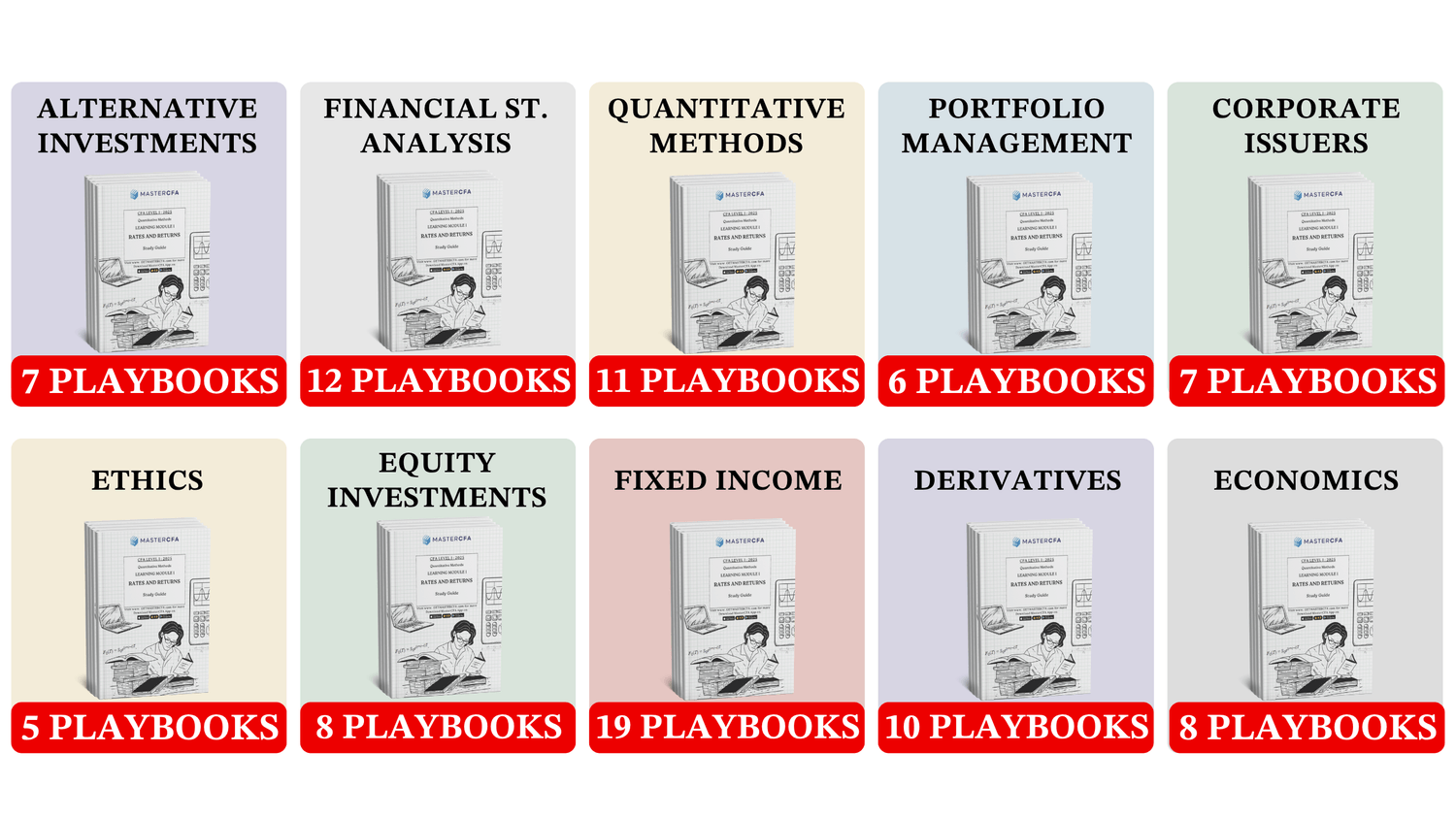

What's Included?

CFA Level 1 Complete Topic Coverage

👇🏻93 Playbooks Total👇🏻

Quantitative Methods - 11 Playbooks

1. Rates and Returns

2. The Time Value of Money in Finance

3. Statistical Measures of Asset Returns

4. Probability Trees and Conditional Expectations

5. Portfolio Mathematics

6. Simulation Methods

7. Estimation and Inference

8. Hypothesis Testing

9. Parametric and Non-Parametric Tests of Independence

10. Simple Linear Regression

11. Introduction to Big Data Techniques

Economics - 8 Playbooks

1. Firms and Market Structures

2. Understanding Business Cycles

3. Fiscal Policy

4. Monetary Policy

5. Introduction to Geopolitics

6. International Trade

7. Capital Flows and the FX Market

8. Exchange Rate Calculations

Corporate Issuers - 7 Playbooks

1. Organizational Forms, Corporate Issuer Features, and Ownership

2. Investors and Other Stakeholders

3. Corporate Governance: Conflicts, Mechanisms, Risks, and Benefits

4. Working Capital and Liquidity

5. Capital Investments and Capital Allocation

6. Capital Structure

7. Business Models

Financial Statement Analysis - 12 Playbooks

1. Introduction to Financial Statement Analysis

2. Analyzing Income Statements

3. Analyzing Balance Sheets

4. Analyzing Statements of Cash Flows I

5. Analyzing Statements of Cash Flows II

6. Analysis of Inventories

7. Analysis of Long-Term Assets

8. Topics in Long-Term Liabilities and Equity

9. Analysis of Income Taxes

10. Financial Reporting Quality

11. Financial Analysis Techniques

12. Introduction to Financial Statement Modeling

Equity Investments - 8 Playbooks

1. Market Organization and Structure

2. Security Market Indexes

3. Market Efficiency

4. Overview of Equity Securities

5. Company Analysis: Past and Present

6. Industry and Competitive Analysis

7. Company Analysis: Forecasting

8. Equity Valuation: Concepts and Basic Tools

Fixed Income - 19 Playbooks

1. Fixed-Income Instrument Features

2. Fixed-Income Cash Flows and Types

3. Fixed-Income Issuance and Trading

4. Fixed-Income Markets for Corporate Issuers

5. Fixed-Income Markets for Government Issuers

6. Fixed-Income Bond Valuation: Prices and Yields

7. Yield and Yield Spread Measures for Fixed-Rate Bonds

8. Yield and Yield Spread Measures for Floating-Rate Instruments

9. The Term Structure of Interest Rates: Spot, Par, and Forward Curves

10. Interest Rate Risk and Return

11. Yield-Based Bond Duration Measures and Properties

12. Yield-Based Bond Convexity and Portfolio Properties

13. Curve-Based and Empirical Fixed-Income Risk Measures

14. Credit Risk

15. Credit Analysis for Government Issuers

16. Credit Analysis for Corporate Issuers

17. Fixed-Income Securitization

18. Asset-Backed Security (ABS) Instrument and Market Features

19. Mortgage-Backed Security (MBS) Instrument and Market Features

Derivatives - 10 Playbooks

1. Derivative Instrument and Derivative Market Features

2. Forward Commitment and Contingent Claim Features and Instruments

3. Derivative Benefits, Risks, and Issuer and Investor Uses

4. Arbitrage, Replication, and the Cost of Carry in Pricing Derivatives

5. Pricing and Valuation of Forward Contracts & for an Underlying with Varying Maturities

6. Pricing and Valuation of Futures Contracts

7. Pricing and Valuation of Interest Rates and Other Swaps

8. Pricing and Valuation of Options

9. Option Replication Using Put–Call Parity

10. Valuing a Derivative Using a One-Period Binomial Model

Alternative Investments - 7 Playbooks

1. Alternative Investment Features, Methods, and Structures

2. Alternative Investment Performance and Returns

3. Investments in Private Capital: Equity and Debt

4. Real Estate and Infrastructure

5. Natural Resources

6. Hedge Funds

7. Introduction to Digital Assets

Portfolio Management - 6 Playbooks

1. Portfolio Risk and Return: Part I

2. Portfolio Risk and Return: Part II

3. Portfolio Management: An Overview

4. Basics of Portfolio Planning and Construction

5. The Behavioral Biases of Individuals

6. Introduction to Risk Management

Ethics - 5 Playbooks

1. Ethics and Trust in the Investment Profession

2. Code of Ethics and Standards of Professional Conduct

3. Guidance for Standards I–VII

4. Introduction to the Global Investment Performance Standards (GIPS)

5. Ethics Application

$10 USD = Rs.890

In case we haven't met yet...

Hey, I'm Devesh! 👋

I quit management consulting because I was burnt out.

Loved the grind and the learning.

But being "busy" in 3 time zones takes it toll.

So I did the next obvious thing: MBA.

But I was an average engineer with a 7/10 GPA from a little college in Rajasthan, called BITS Pilani.

The competition, especially in India, is cut throat.

So I signed up for every exam I could find, to help 'boost' my profile for interviews.

CFA. FRM.

CAT. GMAT.

XAT.

All of them. Because why not?

Then the scheduling system did me dirty.

When the exam dates were released, my soul quietly left my body.

Instead of spreading them out, the calendar stacked them like a bad joke:

FRM — 15th Nov.

CAT — 16th Nov.

CFA Level I — 6th Dec.

GMAT, XAT and so on.

So 3-4 'kinds' of exam in the same 30 day period.

If you know these exams, you know that's borderline lunacy.

FRM = pure, merciless quant.

CAT = speed and trapdoors - one wrong answer and your percentile vaporizes.

CFA = an ocean of content that drowns the unprepared.

But I'd paid the fees.

My pride and ego had already signed the checks. No refunds.

So I did the only sane thing left: saw Deadpool and yelled "MAXIMUM EFFORT".

Grinded 7-10 hrs a day.

It was brutal, but practical, and repeatable.

Techniques for remembering.

Tricks and hacks to solve quicker.

After all I had to retain and retrieve assorted information for DIFFERENT Exams. FAST.

Well long story short - it worked out.

✅ Passed CFA Level 1

✅ Passed FRM Level 2

✅ ~99 percentile in CAT

✅ 720 on the GMAT

The time constraint had made me notice something the rest of the room missed.

Most candidates were reading 3,000-page bibles and calling it "studying."

They were pouring hours into low-yield fluff while the high-impact material sat ignored.

I used the same techniques in my career later to work for Fortune 500 companies, be a part of the biggest M&A in the global history and work across functions as a right hand man to CXOs.

Years later, I decided to built MasterCFA so that I can give back to the community.

Analytics and content that matters.

And it starts with these playbooks.

93 razor sharp playbooks.

One for each module of the curriculum.

Ten pages. Maximum signal. Minimum noise.

Students who use this approach can cut study time by 40% and actually improve scores.

Want it?

It's just $10. Instant PDFs. Lifetime access.

Click the button below and get to work.

Best of Luck,

Devesh.

$10 USD = Rs.890

Frequently Asked Questions

Write to us at support@mastercfa.com if you don't find your answers here.

A: Even better! These playbooks are like treasure maps - they will show you the best routes for you to reach your goal faster.

A: Each playbook takes 30-45 minutes to read and 1-2 hours to fully implement. Everything is designed for busy professionals who need efficient study methods!

A: Yes! All 10 topic areas plus calculator skills and exam strategy. Every single reading from the CFA curriculum is covered in high-yield forma

A: Use this to start practicing Questions. If you want MasterCFA has 8000+ Questions - download the app from app store for FREE!

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of META, Inc

CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by MasterCFA. CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Write to support@mastercfa.com in case of issues.

Grab Your FREE Mini-Course!

CONTAINS:

How to Study For CFA Level 1 Without Wasting 300 hours : 28 minutes

Question Solving Strategy: How to solve CFA Q.s in 90secs : 31 minutes

You will receive an email for confirmation please click on it to access your course.

We HATE spam. Your email address is 100% secure